Balance Sheet: Explanation, Components, and Examples

Content

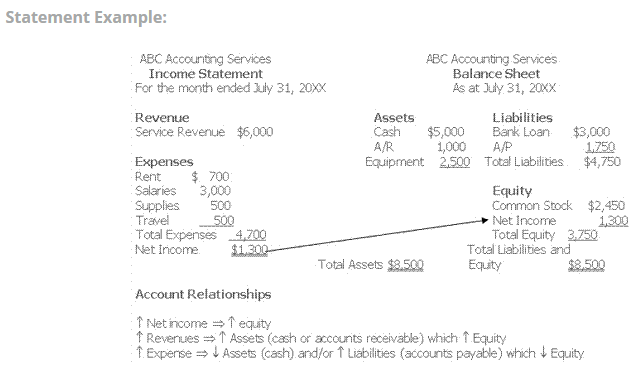

A balance sheet considers a specific point in time, while a P&L statement is concerned with a set period of time. A balance sheet provides both investors and creditors with a snapshot as to how effectively a company’s management uses its resources. As the diagram above illustrates, there are several types of expenses. The most common way to categorize them is into operating vs. non-operating and fixed vs. variable. You pay off expenses in real-time because they’re necessary for ongoing business operations.

Additionally, you can calculate net income using its statement of owner’s equity and use the result to calculate total expenses. This post looks at calculating, tracking, and managing your total expenses. Section 212 of the Internal Revenue Code is the deduction provision for investment expenses.

What’s included in an income statement?

A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price.

This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes on a bank loan to be paid off in 5-years, this account will include the portion of that loan due in the next year. Liabilities finance your business and pay for large expenditures. If you don’t pay a liability, you will essentially default on the loan or obligation. For example, if you don’t pay off a loan from a bank or supplier, then you default, which could lead to legal action.

Income Statement and Balance Sheet – What’s the Difference?

Companies that use accrual accounting often end up with deferred expenses on their balance sheets. That’s because under accrual accounting, accountants recognize expenses when they occur, not when the company pays the bills. Once the company is able to recognize the expense, balance sheet expense the accountant removes the deferred expense from the balance sheet. For the most part, the more your business earns, reflected by the bottom line of your profit and loss statement, the greater the value of the assets that will be reflected on your balance sheet.

These are considered expenses that you pay to help grow your business operations and increase revenue. It’s one of the key components in determining your business’s net income. Depending upon the legal structure of your practice, owners’ equity may be your own , collective ownership rights or stockholder ownership plus the earnings retained by the practice to grow the business . Some practitioners are more familiar with financial terminology than others. You may find it helpful to consult a glossary of financial terms as you read this article.

Cost Transfers/Expenditure, Revenue, and Balance Sheet Adjustments

Eventually, the information in the trial balance is used to prepare the financial statements for the period. The most liquid of all assets, cash, appears on the first line of the balance sheet. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. When expenses are accrued, this means that an accrued liabilities account is increased, while the amount of the expense reduces the retained earnings account. It’s important to stay on top of these financial statements so your business can grow.

- Better manage and report on assets and liabilities for your investors with this software.

- The notes contain specific information about the assets and costs of these programs, and indicate whether and by how much the plans are over- or under-funded.

- It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

- A sample balance sheet for the fictitious Springfield Psychological Services at December 31, 2004 and 2003 is presented below, as an example.

- Also, there are specific guidelines for the disclosure of this exp. in the financial statements.

A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. A balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholder equity. Shareholder equity is equal to a firm’s total assets minus its total liabilities and is one of the most common financialmetricsemployed by analysts to determine the financial health of a company. Shareholder equity represents the net value of a company, meaning the amount that would be returned to shareholders if all the company’s assets were liquidated and all its debts repaid.

Intangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can’t touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. The blank balance sheet template can be downloaded in a range of formats to suit your preferred software program, from Microsoft Excel and Microsoft Word to Google Docs or Google Spreadsheets. Find the best finance statement templates for you and your business. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Wages payable is salaries, wages, and benefits to employees, often for the most recent pay period.