Capitalization: What It Means in Accounting and Finance

Content

Remember that setting your limit high will mean you have fewer reportable assets. This looks suspicious and could trigger an audit by the IRS, which can be time-consuming and costly for your business. The expenditure should be capitalized when it results in the Betterment, Adaptation, or Restoration of the unit of property. The asset will be recorded on the balance sheet, where it will increase the worth of the company. Depending on who you ask, capitalization is either the provision of capital for a company or the conversion of assets into capital. But later on, the company’s return on assets and return on equity are lower because net income is higher with a higher assets balance.

- An expense is a business resource that will expire or will be consumed by the business within one year or the normal operating cycle of the business – depending on whichever time period is longer.

- Accessory equipment should be considered as a portion of the first cost of the capital item if it was invoiced at the time of initial purchase.

- Leased assets under ASC 842 can be accounted for in one of two ways, which have important distinctions and convey different information to investors.

- We will start with a capital/finance lease example because they have always been capitalized.

- The total amount paid for the asset, in cash or kind, is considered the “cost-basis.” This should include all charges relating to the purchase, such as the purchase price, freight charges, and installation, if applicable.

- In addition to this usage, market capitalization refers to the number of outstanding shares multiplied by the share price, which is a measure of the total market value of a company.

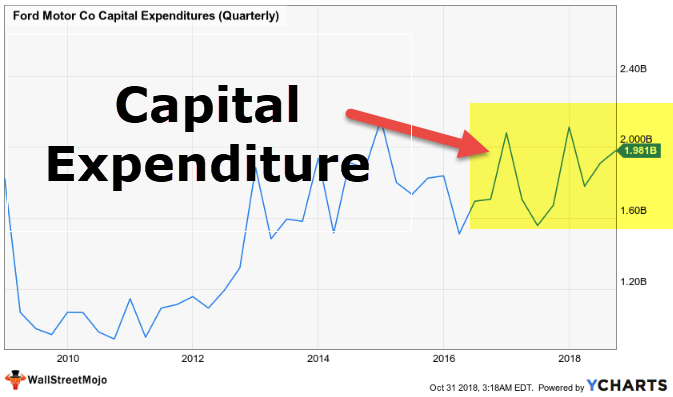

Capitalization is the method chosen to record the purchase of a fixed asset on the company’s accounting books. If an asset is capitalized then it is not expensed in the same year the asset is purchased. Instead the asset is generally recorded on the balance sheet and individually on an asset schedule. Examples of capital expenditures are purchases of land, buildings, machinery, office equipment, leasehold improvements, and vehicles. Capitalization is an accounting rule used to recognize a cash outlay as an asset on the balance sheet—rather than an expense on the income statement.

II. Capitalization of Movable Equipment

You would normally capitalize an expenditure when it meets both of the criteria noted below. Depreciation is an expense recorded on the income statement; it is not to be confused with “accumulated depreciation,” which is a balance sheet contra account. The income statement depreciation expense is the amount of depreciation expensed for the period indicated on the income statement. In accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. This means you will be charged more personal property taxes, possibly for years to come.

What assets must be capitalized?

Fixed assets are capitalized. That's because the benefit of the asset extends beyond the year of purchase, unlike other costs, which are period costs benefitting only the period incurred. Fixed assets should be recorded at cost of acquisition.

In those cases, a change in an asset’s estimated life for depreciation may be all that is needed. Impairment is typically a material adjustment to the value of an asset or collection of assets. For example, most businesses use five years as the useful life for automobiles. In practice, a particular business may have a policy of purchasing and trading in automobiles every three years. As with all accounting rules, materiality should be considered in determining whether the recognition of residual values is needed.

Before we start.

”Wipfli CPA” is the DBA name of Wipfli LLP in New York state, and refers to Wipfli LLP. Ignore changes in an asset’s use or service; you may need to consider asset impairment. Any item that will retain no value after 12 months may be expensed. Do note that the IRS may frown upon deductions that appear to take advantage of end-of-year timing.

Under ASC 842, ROU assets can either be finance assets or operating assets, and the accounting for each is slightly different. The decision whether to capitalize an asset or not is a critical business issue because it could influence the profits or losses of a business. The P & L results, in turn, can affect the business’s net worth, its tax liability and potentially debt covenants – the financial ratios required by a lender. The process records the cost of an asset by adding it to the balance sheet, which increases the worth of the company, and reduces its value to the company over its useful life by a series of monthly or annual journal entries. Land – Real property or water rights owned by the university not held as investment property.

Free Accounting Courses

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Set your limit based on the present-day and forecasted needs of your business. Get instant access to video lessons asset capitalization taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Are free-standing, useable free of support from other equipment, or meets the requirements in statement 4 below.

A purchase of both land and buildings requires that the cost be allocated between the assets. When it comes to accounting for leases under US GAAP, the fundamental change with ASC 842 is operating leases, previously just expensed when paid, now have to be capitalized. This accounting rule change occurred because, from a business perspective, both capital/finance and operating leases resulted in an organization accepting a financial commitment in exchange for the right to use an asset. However, the terms of the agreement dictate whether the organization is financing the purchase of an asset with a financing lease or paying for the use of an asset with an operating lease. Some of the conceptual differences in how leased assets are capitalized are discussed below.