Indicator DeMarker: how to trade a price turn with a minimal risk

Contents:

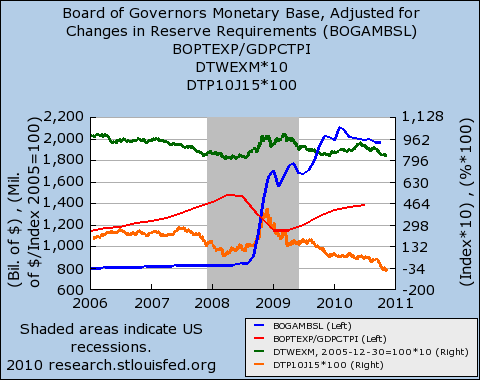

For this reason, it is often used in combination with other technical indicators. The default setting has overbought and oversold lines set at 0.7 and 0.3 respectively. When the reading stays in between these two levels, DeM indicates that the market is likely trading sideways and implies lower volatility. If a market stays at slight overbought levels — say, above 0.5, but below 0.7 — for an extended period, it suggests a modest uptrend. Over the number of periods, ‘N’, the high of each bar is compared to the previous high.

DeMarker Indicator (DeM) Definition, Validity & Trading Strategy – Investopedia

DeMarker Indicator (DeM) Definition, Validity & Trading Strategy.

Posted: Sat, 25 Mar 2017 23:33:37 GMT [source]

The idea is this makes the Daily Play Ace Spectrum more suitable for use on shorter time scales. These specific parameters exposed still maintain the original form … This is joining open of consecutive days which will help in knowing the trend between two-days. Can be used to direct or supplement your analytical approach, allowing traders and investors of all types to benefit. The material provided on this website is for information purposes only and should not be understood as an investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents.

Overbought and oversold levels

Experience with the DeMarker in tandem with other technical indicators can tilt the odds in your favour when evaluating potential trading setup opportunities. The main essence of the demarker indicator is that it can identify areas of price depletion, which most often correspond to local extremes . Identifying overbought and oversold market conditions is one of the most common uses of oscillator technical indicators which also include the stochastics oscillator and CCI.

It’s this versatility that makes the work so valuable to the top names on Wall Street. A outline of tradeer timescale will make the indicator more sensitive and is better for spotting entry and exit points but it will also increase choppiness and make false signals more likely. When the «strong» local extremum is detected, confirmed by the large market volumes, the indicator can generate signals opposite to the current trend, so you need to be careful. The reasonable use of the DeMarker indicator significantly reduces the risk of any trading strategy. As a result, a turn from this area of the «exhaustion» is more reliable.

Naturally, the wider the selection available to you, the better choice of indicator you can make. Though MetaTrader 4 and MetaTrader 5 already come with a decent choice of standard indicators, you can easily provide yourself with a wider suite of tools by downloading MetaTrader Supreme Edition. MTSE is a custom plugin for MT4 and MT5, developed exclusively for Admirals by industry experts, that offers a cutting-edge selection of trading features. The larger the number of periods you use, the smoother the curve of the DeMarker Indicator. For smaller periods, which give sharper oscillations, you might want to consider a higher boundary for overbought, and a lower boundary for oversold.

Live Trading with DTTW™ on YouTube

As with any technical indicator, a DeMarker indicator will never be 100% correct. False signals can occur, but the positive signals are consistent enough to give a forex trader an “edge”. Skill in interpreting and understanding DeM signals must be developed over time.

- It’s this versatility that makes the work so valuable to the top names on Wall Street.

- If the magnitude of the high and low is less extreme than in the previous bar, a value of zero is recorded.

- The Exit 1 indicator compares the closing prices of trending price bars to identify potential short term price reversals.

- Fundamental analysis is a method that relies on news and economic data to determine the direction of an asset.

Shifts also tend to be swift; when this https://1investing.in/ moves from overbought to oversold status, it is a signal a reversal is imminent. The DeMarker is classified as an oscillator since the resulting curve fluctuates between values of zero and “1”. However, some variants of the indicator have a “100” and a zero scale, as well as “100” versus “-100” on some charts. The indicator typically has lines drawn at the “0.30” and “0.70” values as warning signals.

Time-Tested Market Timing

The Moving Average 2 indicator applies two separate moving averages to a price chart and compares relative values to identify the trend’s direction. The moving averages are displayed in blue when comparative values are ascending and red when comparative values are descending. The Anti-Differential indicator identifies zones of price exhaustion and potential price reversals. It compares the buying and selling pressure of a series of consecutive bars to determine the likelihood of a future rally or decline.

Tom Demark indicators are well-known for their mechanical-driven approach that leaves no room for any type of misinterpretation. Tom Demark indicators have been applied in the market since the 1970s to today across the stock market, futures market, fixed income market, and Forex currency market. Looking at this period is important because it affects your trading strategy. In most charts, the indicator uses a period of 14 but this can be changed. The Moving Average 1 indicator considers both price and time to define when a chart is trending and when the trend goes dormant. The Gap indicator identifies both Gaps and Laps while attempting to validate whether or not they will be filled prior to a reversal in trend.

In essence, the former route is trend confirming while the latter is trend anticipatory. So, while useful on its own, like any technical indicator, the DeMarker indicator is better combined with other indicators to confirm its signals. Oscillators were developed to try to filter out fake moves in a market. In strong trends they will follow the same pattern as the price, but towards the end of a trend the oscillators will fail to confirm the movement. Nevertheless, in the most cases they signal about the forthcoming breakthrough on the price chart. Let’s look at a current real-time trading example using the DeMarker strategy.

How to Trade with the DeMarker Indicator

Unlike the Relative Strength Index , which is perhaps the best-known oscillator, the DeMarker indicator focuses on intra-period highs and lows rather than closing levels. The DeMarker indicator, or DeM, is a technical tool deployed by traders to measure the demand for the underlying asset. Thus, we are now deploying the DeMarker indicator to identify potential price levels where a change in the price direction may occur soon. Here we have a USD/JPY daily chart that trades in a downtrend as the price action has been creating a series of the lower highs and lower lows. From this comparison, it aims to assess the directional trend of the market.

The Reverse Camouflage indicator uncovers price activity not readily apparent through traditional measures. The Reverse Camouflage indicator identifies short-term divergences that can be used to anticipate the following price bar’s potential activity. The Open indicator compares the current bar’s open and subsequent price activity to a prior bar’s reference point to establish near term direction. The Carrie study attempts to participate in short term breakouts by identifying critical price levels that previously served as important price resistance and support. A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average. Although DeM is advertised as a method to time trend reversals, in several cases, large price movements that followed a signal maintained the direction of the existing trend.

Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators. Reverse Differential is designed to indicate short-term price breakout possibilities by comparing the buying/selling pressures of recent price bars.

Auto TrendLine Indicator

The In Range indicator identifies a series of consecutive closes and compares each bar’s close relative to the prior bar’s high or low. An up or down arrow appears upon completion, suggesting the direction of a likely reversal. The Fibonacci Intraday indicator is a short-term study that utilizes Fibonacci-derived values to generate intrabar levels of exhaustion.

When used in conjunction with other DeMARK Indicators, the Clopwin indicator can also be used to initiate entries and exits. Unlike other oscillators, DeMark designed his indicator to make comparisons from one time period to the next, based on each pricing cycle’s relative highs and lows. His algorithm was then an “If/Then” kind of computer logic, which delivered a reflection of investor support for each successive moment. As with any indicator, practising trading on a demo system is the best way to learn how to incorporate the DeM into your trading toolbox. Combined with another indicator, it can become a powerful addition to your trading arsenal.

The DeMARK Breakout Qualifiers are a series of objective rules that can be applied to multiple DeMARK Indicators to gauge whether a breakout above or below a level is expected to continue. A Disqualified Breakout indication does not meet the breakout criteria and suggests a lower likelihood that the move will persist in the short-term until a Qualified Breakout occurs. Overbought and oversold conditions are likely to be imminent when the curve crosses over these boundary lines.

Professional Tools for Your Trading Success

As with any technical analysis tool, the DeMarker indicator uses pricing behaviour in the past to forecast future behaviour. It compares the maximum and minimum prices in the current time period with those achieved in the previous period. Most oscillating indicators tend to be lagging, but as demonstrated, the DeM has a unique ability to predict reversals in market pricing behaviour. False positives can occur, but the odds can favour the trader when it is used in combination with other indicators. Practice sessions will help you see this technical tool’s subtleties and incorporate it into a successful trading strategy.

There are several ways to build a robust trading strategy that involves the unique signalling power of the DeM. The DeMarker is classified as a leading indicator based on how its formula works with market prices. Unlike the popular Relative Strength Index , the DeM does not rely on closing price points. It looks at the entire trading period for highs or lows, thereby avoiding a bit of the chaos that can distort other indicators. As it bounces back and forth between its extremes, it illustrates the changing tides of both buying and selling pressures.

The Directional indicator relates the current bar’s close to its open in an effort to gauge short-term market direction. The Aggressive Sequential indicator is used to accelerate the Countdown method. This substitution process is more forgiving than its traditional Sequential counterpart and identifies areas of likely price exhaustion during periods of increased volatility. The Aggressive Combo indicator is used to accelerate the Countdown method. This substitution process is more lenient than its traditional Combo counterpart and identifies areas of likely price exhaustion during periods of increased volatility. Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior.

The Variable Aggressive Sequential indicator is the Aggressive Sequential indicator with an alternate menu structure. The Variable Aggressive Combo indicator is the Aggressive Combo indicator with an alternate menu structure. The Risk Level calculation defines the zone within which an expected market reaction should occur. If the price exceeds this value following the completion of a Setup or Countdown phase, the probability of the expected market response is diminished.

- As it bounces back and forth between its extremes, it illustrates the changing tides of both buying and selling pressures.

- Partner with ThinkMarkets today to access full consulting services, promotional materials and your own budgets.

- The confirmation from additional oscillators, trend instruments or candlestick analysis is necessary.

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting. The Demarker indicator is an oscillator that displays potential overbought and oversold conditions in the market. Being part of the oscillator family of technical indicators, this technical tool oscillates over time within a band between the 0 and 100 levels (or 0.0 and 1.0). The Channel 3 indicator identifies the market’s tendency to trade within a price band. The extremes are displayed as an upper and lower band generated by short term moving averages for a series of bars.

The DeMarker indicator can then aid the forex trader on when to enter the market and when to close a position. When it breaks out of one of these ranging periods, it is time to take notice. It is helpful to combine a trend following indicator like a moving average to confirm the DeM signal before reacting to what could be a false alert.

Partner with ThinkMarkets today to access full consulting services, promotional materials and your own budgets. ThinkMarkets ensures high levels of client satisfaction with high client retention and conversion rates. DeMarker indicator is indicative of lower volatility and a possible price drop when reading 0.7 and higher. But this will reduce even more from the potential trade opportunities.

Each trend contains advances and pullbacks, driven by news, events, fundamentals, technicals, order flow, sentiment and emotion. Market timing seeks to navigate the risks and the opportunities these variables create. Unlike other methods, these proprietary studies are designed to identify areas of potential price inflection before the market responds, enhancing your investment analysis and timing.

Tom DeMark says technical indicators are flashing downside risks to stocks. Here’s what he says about the euro and bitcoin. – MarketWatch

Tom DeMark says technical indicators are flashing downside risks to stocks. Here’s what he says about the euro and bitcoin..

Posted: Tue, 27 Sep 2022 07:00:00 GMT [source]

Our preferred Demarker setting is to use a parameter value of 13 periods. We also like to tweak the overbought and oversold levels and instead of using the classical 0.7 and respectively 0.3 levels we use the 0.9 and respectively 0.1 levels. A divergence is a situation where the price of an asset is acting different from the oscillators. Finding overbought and oversold levels is the most common approaches of using the DeMarker indicator. The DeMark indicator does not focus on closing levels as the RSI does.